请翻译下面内容,重写翻译后的标题使其更吸睛,确保翻译完全,保留所有html代码和标签,不要包含思考和解释等内容,不要增加额外内容,直接给出纯文字结果:

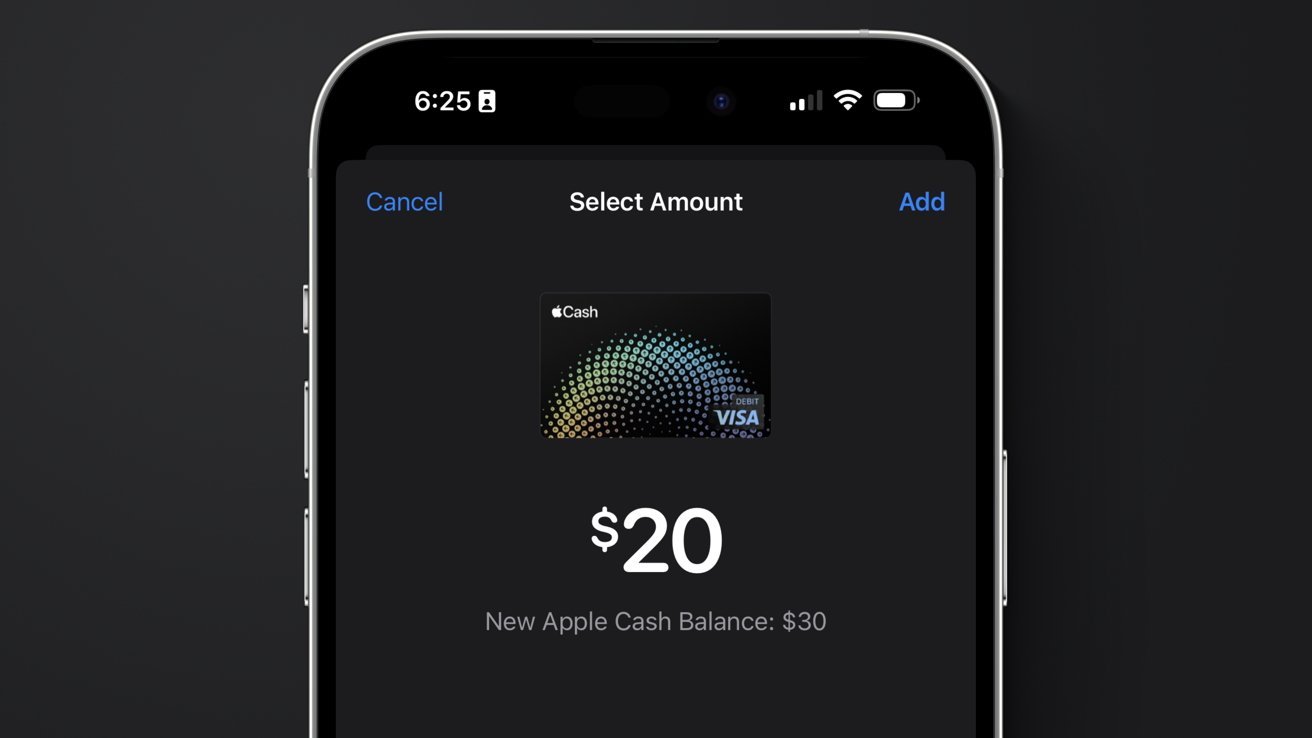

Apple will raise the fee for Apple Cash Instant Transfers to 1.7% starting in mid-February, increasing the maximum charge while leaving slower bank transfers free.

Apple updated the Apple Cash Terms and Conditions on January 23 to reflect a higher fee for Instant Transfers to an eligible debit card. Beginning February 18, Instant Transfers will cost 1.7% of the transaction amount, up from 1.5%, with a $0.25 minimum and a $25 maximum.

The change applies only to Instant Transfers initiated from Apple Cash through the Wallet app. Standard bank transfers using the Automated Clearing House network will continue to be offered at no cost.

Apple Cash supports two types of transfers out of a balance. ACH transfers move money to a linked bank account and typically complete within one to three business days.

Instant Transfers send funds to an eligible debit card using the card’s payment network and usually complete within minutes. The faster option carries a percentage-based fee set by Apple and its banking partners.

What is changing on February 18

Before February 18, Instant Transfers cost 1.5% of the transaction amount, capped at $15. After the update, the fee rises to 1.7%, and the maximum charge increases to $25, while the $0.25 minimum remains unchanged.

The Terms specify that fees are rounded to the nearest cent and confirm Apple’s ability to adjust pricing again in the future. No other Apple Cash fees are changing.

Instant payouts across consumer payment services have gradually become more expensive. Venmo, Cash App, and PayPal all charge similar percentage-based fees for immediate access to funds, often clustering between 1.5% and 2% with caps.

Apple’s updated pricing keeps Apple Cash within that industry range rather than positioning it as a low-cost outlier. The move reflects broader normalization of instant-payment fees rather than a sharp break from past behavior.

The raised cap is the bigger shift

The increase from 1.5% to 1.7% is modest on smaller transfers. The more meaningful change is the maximum fee rising from $15 to $25, which affects higher-value withdrawals.

An adjustment like that aligns Apple Cash more closely with competitors that already impose steeper penalties for speed at larger amounts. The structure makes Instant Transfers less attractive for moving larger balances quickly.

Apple isn’t removing free transfers or slowing them down

Apple isn’t removing free transfers or slowing them down. ACH transfers remain prominently available for users who can wait a short period to access funds.

The pricing change appears designed to discourage routine use of Instant Transfers rather than eliminate them. Users who plan even a day ahead can still avoid fees entirely.

Apple Cash is structured as a prepaid balance for peer-to-peer payments, short-term holding, and Apple Pay transactions. It’s not positioned as a primary banking or checking account replacement.